Will a 770 Credit Score Get Me an Auto Loan with low interest?

Q: I am hoping to apply for an auto loan tomorrow, my credit score stands at 770. Will I be able to obtain a car loan with low interest?

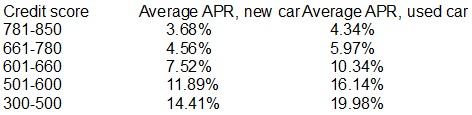

A: It’s possible to successfully get an auto loan with a credit score of 770 and not get sky-high interest rates. Think about this loan data from the guys at Experian:

If your credit score is of about 770, you will definitely a better expectation of being eligible for that loan if you submit a request for vehicle loans online. Using this method makes it easy to do a comparison of all the offers from a large diversity of loan companies. If you aren’t certain where to begin, check out our extensive list of companies.

Exactly the same strategy holds true for auto loans for borrowers with credit scores of 771, 772, 773, 774, 775, 776, 777, 778 and 779.

How to improve your interest rate and credit rating

Even though you can successfully try for an auto loan or personal loan with a 770 credit score, you might receive a slightly more reasonable rate if you pay a more substantial deposit on the vehicle.

Below are some suggestions for perhaps raising your credit score before you apply for a car / auto loan:

- Clear as many outstanding debts and bills as you can.

- Credit cards, decrease your credit liability to less than 30%.

- Order free credit reports, examine them for flaws and question any that you find.

- Some loan providers are willing to forgive one-off failures and get them wiped from your record. Find out if this applies where you are concerned.

- Join Experian Boost to get your utility and phone payments counted toward your credit rating.