Will a 600 Credit Score Get Me an Auto Loan?

Q: I need to apply for an auto loan soon, but my score is only 600. Will I be able to get a car loan, or am I going to be declined everywhere I go?

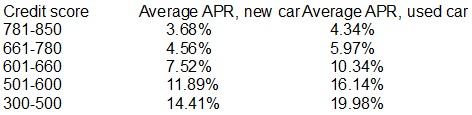

A: It is entirely possible to apply successfully for an 600 credit score auto loan. Consider this data which comes straight from Experian:

In fact, Experian also stated that vehicle loans for borrowers with scores of under 600 accounted for 20% of all 2019 auto loans!

With a credit score close to 600, you will have the best luck qualifying for a loan if you apply for vehicle loans online. Doing so will make it possible to compare offers from a larger selection of lenders, and you will be working with companies that are more flexible when it comes to approving low credit borrowers. If you are not sure where to begin, check our list of recommendations.

The same answer applies to auto loans with credit score 601, 602, 603 and 604.

Credit scores affect your monthly payment amount

Even though you can successfully apply for an auto loan or personal loan with a low credit score, the downside is that interest rates tend to be higher. You may be able to qualify for a more competitive interest rate if you can put more money down on the vehicle. You also can try to boost your FICO score.

Car dealer Loans

When applying for car loans at a car dealer they will always go through your credit report and your credit history, checking your payment history. Most often they have good loan rates but their car loan almost always require a down payment being made first.

Improve your credit score & interest rate

Here are some ideas for potentially raising your credit score prior to applying for a car / auto loan:

- Get current on as many debts and bills as you can.

- Sign up for Experian Boost to get your utilities and phone bill payments to count toward your credit score.

- Credit cards, reduce the amount of your credit you are utilizing below 30%.

- Order your free credit reports, check them for errors, and contest any you find.

- Some creditors are willing to forgive one-time mistakes and expunge them from your record. Check into this if it is applicable to your situation.