Will a 760 Credit Score Get Me an Auto Loan with a low interest?

Q: I am intending to make an application for an auto loan this week and I’ve got a credit score of 760. Will that be good enough to get a low interest car loan?

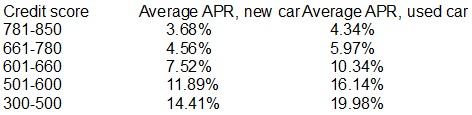

A: It’s without question possible to successfully apply for an auto loan with a credit score of 760 without getting a sky-high interest rate. Consider this data which comes directly from the credit analysis company Experian:

If you have a credit score around 760, you will have the best luck being approved for auto finance if you put in an application for vehicle loans online. Using this procedure will make it very easy to compare prices from a larger variety of loan providers. If you aren’t certain how to go about this, check our extensive list of suggestions.

Exactly the same response applies for auto loans for those having credit scores of 761, 762, 763, 764, 765, 766, 767, 768 and 769.

How to improve your credit rating and interest rate

Though you’ll be able to submit a successful request for an auto loan or personal loan with a 760 credit score, you might be able to get a slightly more affordable interest rate if you can put more cash down on the car in question.

Below are some strategies for potentially increasing your credit score prior to applying for an auto / car loan:

- Many lenders are willing to excuse one-time slip-ups and get them wiped from your credit history. Check if this applies to your situation.

- Sign up to Experian Boost to get your utility and phone payments counted towards your credit score.

- Order free credit reports, check them for errors and question those that you come across.

- Credit cards, lower your credit liability to below 30%.

- Clear as many outstanding debts and bills as is possible.