Will a 700 Credit Score Get Me an Auto Loan with a low interest rate?

Q: I’m aiming to submit an application for an auto loan in the next few days, but I have a credit score of just 700. Will that be high enough to get a low interest car loan?

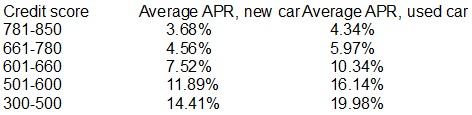

A: It really is entirely possible to apply successfully for an auto loan with just a 700 credit score without getting a sky-high interest rate. Look carefully at this data which comes straight from Experian:

If you’ve got a credit score in the region of 700, you should a better odds of being approved for a car loan if you put in an application for vehicle loans online. Doing this makes it very easy to compare the prices from a larger variety of loan companies. If you aren’t sure how to begin, take a look at our extensive list of services.

Exactly the same solution works well for auto loans for those having a credit score of 701, 702, 703, 704, 705, 706, 707, 708 and 709.

How you can improve your interest rate and credit score

Although it’s possible to successfully put in a request for an auto loan or personal loan with a 700 credit score, you could get a more affordable rate if you pay a bigger deposit on the vehicle. You could also try to boost your current FICO score.

Here are some techniques for perhaps elevating your credit score before you apply for a car / auto loan:

- Join Experian Boost to get your telephone and utility bill payments to count toward your credit rating.

- Credit cards, lower your credit amount to less than thirty percent.

- Several loan companies are prepared to excuse one-time failures and get them erased from your record. Check if this applies where you’re concerned.

- Get on top of as many outstanding debts and bills as is possible.

- Request free credit reports, check them out for errors and challenge any that you discover.