Will a 658 Credit Score Get Me an Auto Loan?

Q: I’ve got to submit an application for an auto loan next week, however I have a credit score of just 658. Will that be good enough to get a car loan, or am I likely to be refused everywhere I try?

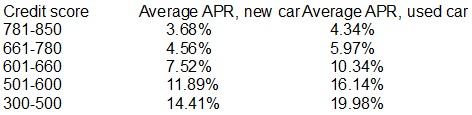

A: It is quite possible to apply successfully for an auto loan with a credit score of only 658. Contemplate this finance data which comes straight from Experian:

In actual fact, Experian confirmed that vehicle loans for car buyers with credit scores under 658 represented 20% of all auto loans in 2019!

If you’ve got a credit score around 658, you will definitely have the best luck being approved for an auto loan if you put in a request for vehicle loans online. Doing so means it is an easy task to do a comparison of offers from a large assortment of loan companies and you’ll be dealing with firms that are a lot more accommodating with respect to approving borrowers with low credit. If you aren’t certain where to start, look at our extensive list of companies.

The exact same resolution is valid for auto loans for folks with credit scores of 659, 660, 661 and 662.

While it is possible to successfully put in a request for a personal loan or auto loan with a poor credit ranking, the down side is that interest rates are often much higher. You may be able to receive a slightly more affordable rate if you put an advance payment down on the car in question. Also you might have a bash at increasing your FICO score.

How you can improve your interest rate and credit score

Let me share some strategies for potentially elevating your credit score before applying for an auto / car loan:

- Settle as many debts and bills as is possible.

- Several loan companies are prepared to pardon one-off slip-ups and get them removed from your credit history. Check into this if it is pertinent to your situation.

- Request free credit reports, check them out for errors and challenge any you come across.

- Credit cards, cut down your credit amount to less than 30%.

- Get registered on Experian Boost to get your phone and utility bill payments counted towards your credit scores.