Will a 610 Credit Score Get Me an Auto Loan?

Q: I am hoping to make an application for an auto loan over the next few weeks, but my credit score is just 610. Is that good enough to obtain a car loan, or will it be declined every place?

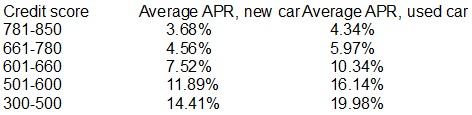

A: It’s possible to apply successfully for an auto loan with just a 610 credit score. Consider this finance data from the guys at Experian:

The fact is, Experian also claimed that vehicle loans for people with scores under 610 accounted for 20% of 2019 auto loans!

If you’ve a credit score somewhere around 610, you will definitely a better likelihood of qualifying for car finance if you make an application for vehicle loans online. This means that it’s simple to do a comparison of all the prices from a broader selection of providers and additionally you will be dealing with firms who are a lot more flexible with respect to authorising borrowers with low credit. If you’re not certain how to begin this process, have a look at the following list of companies.

Exactly the same tactic works for auto loans with a credit score of 611, 612, 613 and 614.

Even though you can successfully try for an auto loan or personal loan with a very low credit standing, the problem is that interest rates are frequently higher. You could receive a more reasonable interest rate if you pay a larger deposit on the vehicle in question. You can also have a bash at maximizing your FICO score.

How you can improve your interest rate & credit rating

Below are some suggestions for possibly boosting your credit score when you need to apply for a car / auto loan:

- Join Experian Boost so your utilities and telephone bill payments count towards your credit scores.

- Some loan providers are prepared to excuse one-off slip-ups and wipe them from your record. See if this is applicable to your situation.

- Get up-to-date on as many bills and debts as you can.

- Credit cards, reduce your credit amount to below thirty percent.

- Order free credit reports, examine them for flaws and challenge any that you come across.