Will a 595 Credit Score Get Me an Auto Loan?

Q: I’m intending to submit a request for an auto loan this week, though I have a credit score of just 595. Is that going to be enough to get a car loan, or am I likely to be refused wherever I try?

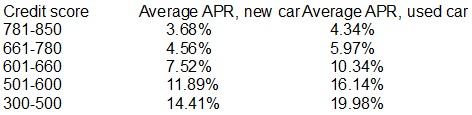

A: It’s entirely possible to apply successfully for an auto loan with a credit score of 595. Look carefully at this loan data which comes straight from Experian:

Indeed, Experian also highlighted that vehicle loans for customers with scores under 595 represented twenty percent of all auto loans during 2019!

If your credit score is of about 595, you should a better probability of approval for auto finance if you put in a request for vehicle loans online. Using this strategy will make it simple to compare all the offers from a broader assortment of loan companies and you will be dealing with lenders who are much more flexible when it comes to approving low credit score borrowers. If you are not certain how to start, have a look at our handy recommendations list.

The same technique works perfectly for auto loans for borrowers having credit score 596, 597, 598 and 599.

Despite the fact that you’re able to submit a successful application for an auto loan or personal loan with an unfavourable credit rating, the downside is that interest rates will be high. You may be able to qualify for a more competitive interest rate if you put an advance payment down on the car in question. You could also try to improve your current FICO score.

Greatly improve your credit score & interest rate

Let me share some strategies for possibly maximizing your credit score before you apply for a car / auto loan:

- Sign up to Experian Boost to get your telephone and utility bill payments counted towards your credit scores.

- Obtain free credit reports, check them for mistakes and dispute any you discover.

- Credit cards, lower your credit amount to below 30%.

- Get on top of as many debts and bills as you can.

- Many lenders will occasionally pardon one-time issues and get them removed from your credit history. Check if this is relevant where you’re concerned.