Will a 580 Credit Score Get Me an Auto Loan?

Q: I have to make an application for an auto loan in the next few days, though I only have a credit score of 580. Is that high enough to get a car loan, or am I going to be refused every place I try?

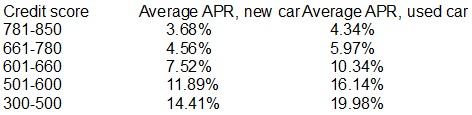

A: It’s quite possible to apply successfully for an auto loan with just a 580 credit score. Think about this data which comes straight from the credit rating company Experian:

In point of fact, Experian highlighted that vehicle loans for applicants with scores of less than 580 characterized 20% of all auto loans in 2019!

If you’ve a credit score somewhere around 580, you can expect to have the best prospect of being approved for car finance if you submit a request for vehicle loans online. Using this technique makes it an easy task to compare prices from a large assortment of loan providers and will also be working together with businesses who are more accommodating with regards to authorising borrowers with low credit. If you’re not certain how to start, take a good look at the following list of recommendations.

The very same resolution applies to auto loans for borrowers having credit scores of 581, 582, 583 and 584.

Even though it’s possible to successfully try for a personal loan or an auto loan with a very low credit score, the flipside is that you will have to pay a much higher interest rate. You could get a more competitive rate if you can put more money down on the car in question. You can also have a shot at enhancing your current FICO score.

Improve your interest rate and credit rating

Here are some strategies for perhaps maximizing your credit score before you apply for a car / auto loan:

- Some lenders sometimes forgive one-time issues and get them wiped from your record. Find out if this can be applied in your situation.

- Get registered on Experian Boost to get your telephone and utility payments counted toward your credit score.

- Get on top of as many outstanding debts and bills as possible.

- Order your free credit reports, examine them for flaws and contest any that you uncover.

- Credit cards, lower your credit amount to less than 30%.