Will a 555 Credit Score Get Me an Auto Loan?

Q: I have to make an application for an auto loan in the next few days, but my credit score is a mere 555. Will that be good enough to get a car loan, or is it going to be rejected wherever I go?

A: It’s quite possible to successfully get an auto loan with only a 555 credit score. Contemplate this information which comes straight from the credit rating company Experian:

Indeed, Experian stated that vehicle loans for borrowers having credit scores under 555 characterized twenty percent of all 2019 auto loans!

With a credit score of around 555, you should a better probability of being approved for a loan if you submit a request for vehicle loans online. Doing this means it’s easy to compare offers from a huge assortment of loan providers and you will also be working together with firms who are way more flexible in regards to approving applicants with low credit scores. If you’re not certain how to begin this process, inspect our useful list of services.

The very same resolution applies for auto loans for those having credit scores of 556, 557, 558 and 559.

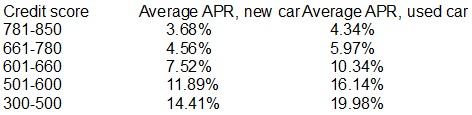

While you’re able to put in a successful application for an auto loan or a personal loan with a very poor credit score, the disadvantage is that you’ll be charged a higher interest rate. You may be able to qualify for a more reasonable rate of interest if you put more cash down on the car in question. You can also attempt to improve your FICO score.

Greatly improve your credit score and interest rate

Allow me to share a few suggestions for potentially increasing your credit score before you apply for an auto / car loan:

- Credit cards, lower your credit liability to less than thirty percent.

- Join Experian Boost to get your telephone and utility payments to count toward your credit scores.

- Get on top of as many debts and bills as you can.

- Many loan creditors are willing to forgive one-off mistakes and get them wiped from your credit history. Check into this if it is applicable in your situation.

- Obtain your free credit reports, check them out for errors and challenge those that you uncover.